community fintech

Community fintech

Fintech | Open Banking

How might we make use of Open Banking technology to improve the financial health of people on low incomes with health conditions?

Project overview

Client

Impact on Urban Health

Main Responsibilities

Project Manager, Producer, Event Planner.

Date

January 2022 - March 2023

01

The brief

In April 2021, Comuzi partnered up with Impact on Urban Health with a hypothesis “How might we make use of Open Banking technology to improve the financial health of people on low incomes with health conditions?”.

The project was scoped out for 18 months and involved working closely with a range of partners. The partners were Shelter, Fair Money Advice and Stockwell also throughout the whole project, we were consulted by Financial Inclusion Advocate, Bailey Kursar.

02

What is Fintech?

Financial technology (fintech) is a term used to describe new tech that seeks to improve and automate the delivery and use of financial services. The idea is that by using tech to make financial services more efficient we can make them quicker, more affordable and more accessible for the general public. Therefore fintech should help lower the cost of borrowing, improve savings rates, make foreign exchange cheaper and make it easier for people to get credit

03

What is Open Banking?

Open Banking is a specific kind of fintech innovation. The idea behind Open Banking is to give you control over how you use your bank accounts, rather than your bank having control.

There are two types of Open Banking:

One is about sharing data, to send transaction and account data from one or more banks into a separate app, for example to aggregate accounts or judge credit risk.

One is about digital payments, Open Banking makes payments quicker and easier for people with banking apps.

04

The Process

The entire project was carried out through 5 stages.

-

Defining questions to answer and confirming who in the community we need to engage with.

-

Learning from those in the community and their needs/values.

-

Finding patterns and areas of opportunity from the insights gathered.

-

Identifying the most impactful Open Banking tools to pilot.

-

Making strategic decisions so we can apply the work in the real world.

05

The Participants

Participants were residents living in either Lambeth or Southwark, primarily from Black or other ethnic minorities, the Portuguese speaking community, and on a low income. They had one or more chronic illnesses:

Physical disabilities

Mental health conditions, or were neurodiverse.

05

The Study

Phase 1

In depth interviews to understand lived experience of low income and poor health

Phase 2

A 74-day trial of Open Banking apps which include Snoop, Plum, Lightning Reach, Money Dashboard and Hype Jar.

06

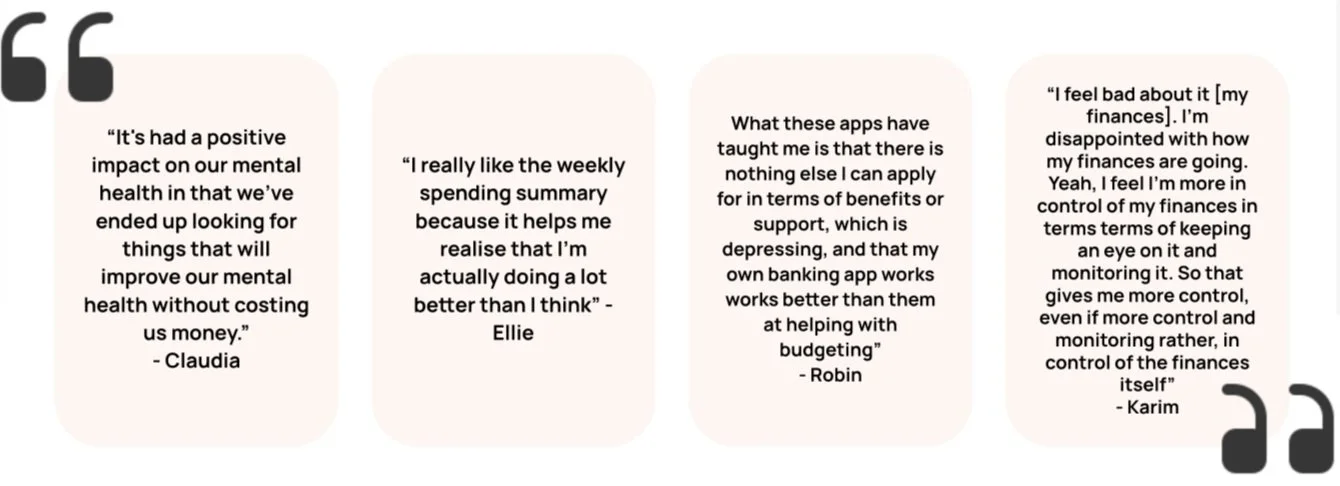

Key Insights

07

The Brunch Event

The brunch was planned and executed by myself and held at Somerset House. The purpose for the event was to showcase the report and bring forth overall findings from the 74 day study. Through these insights, we showed the potential for Open Banking/Finance has to take those in disadvantaged groups (whether those who are at risk of multiple long term health conditions, black and minorities or low income groups) into account when creating future regulations and policies. We brought to light some of the stories and insights we gathered from the study showing real life examples of the impact Open Banking has, particularly in disadvantaged groups. The event was to solely present the report and spark conversation and inspire change.

Main Role: Producer.